Volution is committed to a net zero carbon future.

Carbon emissions – Highlights

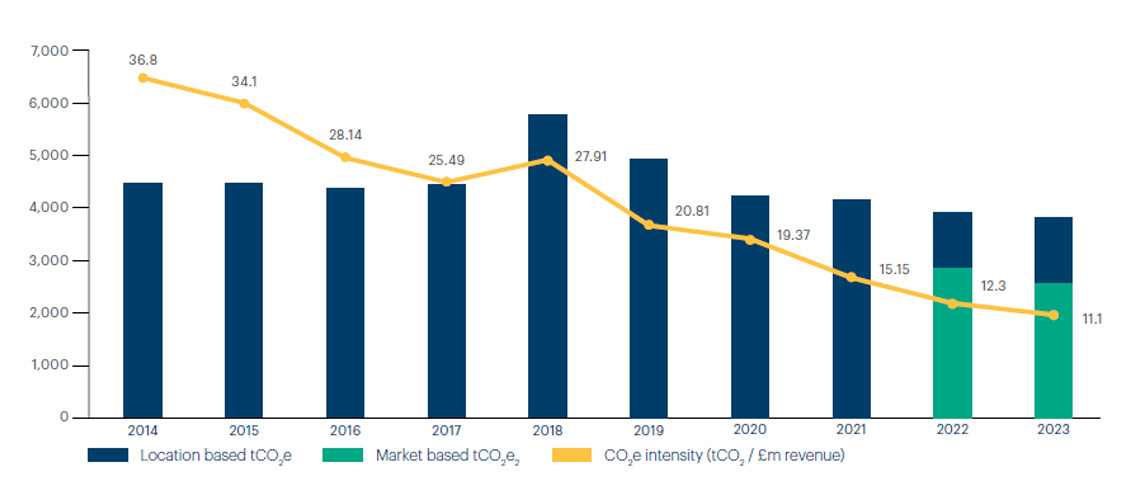

Scope 1 and 2 (Location based) tCO2e

3,628

(3.9% lower than FY22)

1.9% short of FY23 target

Scope 1 and 2 emissions (market based) tCO2e

2,385

(15.6% lower than FY22)

11.4 ahead of FY23 target

Scope 1 and 2 Intensity measure

tCO2e/£million Revenue

11.1

(9.8% lower than FY22)

4.4% ahead of FY23 target

Our approach to the climate change challenge

Preventing the worst impacts of unchecked Climate change is one of the greatest challenges of our time. The IPCC has made it clear that the window of opportunity to ensure the increase in global temperature does not rise above 1.5°C is closing.

The potential physical and other risks of climate change are a concern for everyone, and we as a business have embedded climate change into our risk management and governance frameworks.

However, as a business we must also act to ensure we are contributing to the transition to a zero-carbon economy. This is a challenge, but it is also an investment opportunity – Net zero, concluded a recent UK Government commissioned independent review, ‘is the economic opportunity of the 21st century. ¹ The majority of the world’s nations have now defined a path to net zero: more than 90% of global GDP is now covered by a net zero target. According to FTSE Russell, the green economy recorded a compound annual growth rate of approximately 14% over the last 12 years. The pace of this growth is accelerating thanks to strong political and regulatory tailwinds.

We believe that we are well placed to continue to drive sustainable growth as a response to the Climate Change challenge.

Scope 1 and 2

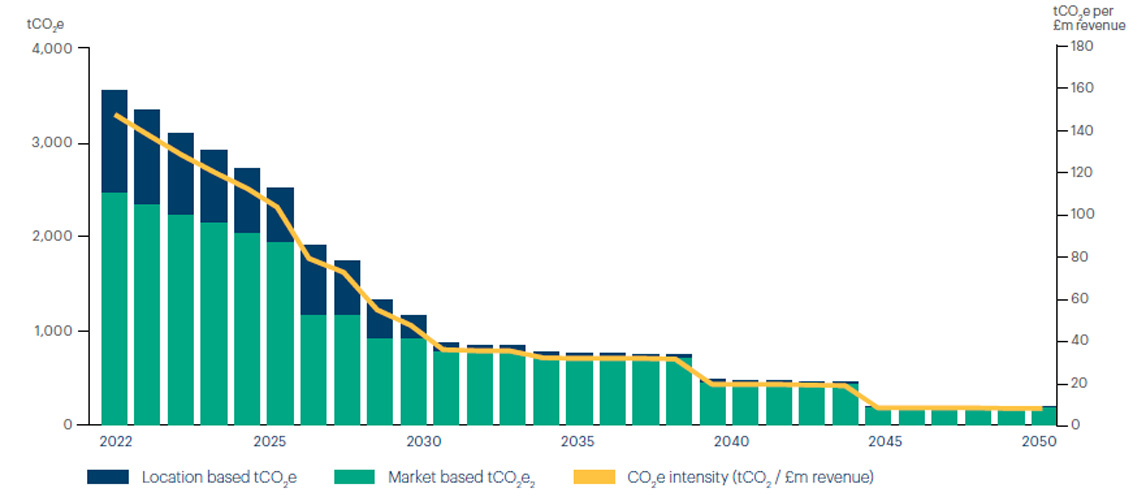

We have made significant reductions in our scope 1 and 2 intensity metric since 2014. Our forecast shows that a combination of Passive, Market-based and Active reductions in emissions puts us on a path to a 90% reduction in carbon emissions by 2050 at the latest. The same forecast shows that we will reduce emissions by significantly more than 50% by 2030. Our forecast and the detailed targets within it are aligned to the SBTi requirements.

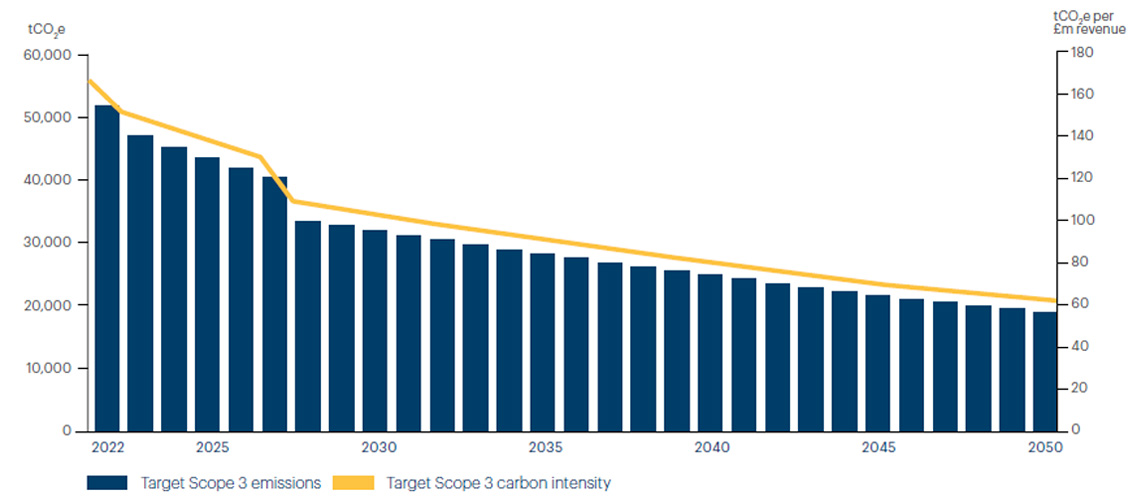

Scope 3

Our forecast for scope 3 emissions shows that our current detailed plans, along with passive reductions, will deliver a significant reduction in our scope 3 emissions. The forecast shows a reduction in scope 3 emissions of around 40% by 2030 and over 60% by 2050. We recognise that these forecast reductions are not yet aligned with our net zero ambitions and will work on further plans and targets to bridge the remaining gap.

A significant portion of the residual emissions in the forecast are the result of the input materials, most notably plastics used in the production of our products. Over time we will explore ways of reducing this embedded carbon which may include reducing the quantity of plastic used in our products, utilising closed-loop recycled plastic, or alternative raw materials.

In reality, it is expected that there will be a more rapid passive reduction in supply chain emissions than has been observed previously due to the availability of low-carbon technology and hence we expect the gap to close when we review in future years.

Scope 1 and 2 Performance – Carbon intensity (tCO2e/£m of revenue) and absolute emissions 2014 to 2023

Scope 1 and 2 Target – Carbon intensity (tCO2e/£m of revenue) and absolute emissions 2022 to 2050

Metrics and Targets

a. The metrics used by the organisation to assess climate related risks and opportunities

We disclose all material scope 1, 2 & 3 carbon emissions, in total and by business. We have set detailed annual targets for scope 1,2 and a proportion of scope 3 emissions and have distributed these targets to each of our local businesses, and we report against these targets.

Our metrics for the % of our total revenue that is from Low carbon and Heat recovery products tracks the extent to which we are utilising the opportunities that Climate change brings. The success of our investments and capital allocation, both in terms of plant and equipment and in the acquisition of low carbon businesses, is reflected in increased sales fromthese products. For the first time in FY23 we have aligned our revenue with the EU taxonomy and continue to report under the FTS Russell Green Economy taxonomy. We believe these externally reported metrics allows us to demonstrate the success of our continued delivery against our sustainable growth strategy.

We show in on page 73 of our Annual Report and Accounts 2023, the proportion of our locations which are at some physical risk from climate change.

b. Scope 1, scope 2, and scope 3 greenhouse gas emissions

This year we have disclosed all material scope 1, 2 and 3 emissions, including for the first time the emissions from the use of our products. Full details of our emissions are shown on page 76 to 77 of our Annual Report and Accounts 2023.

Our Scope 1 and 2 emissions are not material to our total emissions, representing just 6% of ‘operation emissions (excluding emissions from use of products).

Scope 1 and 2 emission sources 2023 are Electricity (51%), Gas (15%), Vehicle fuel (25%), and other (9%).

The largest portion of our location-based scope 1 and 2 emissions is from the electricity we use in our facilities. Scope 3 emission sources 2023 are from the use of products (91%), Distribution (4%), Purchased Products (4%) & other 2%. The largest portion of our scope 3 emissions is from the use of our products, over their useful life.

The methodology we have used to calculate our emissions varies by type of emission and is detailed on page 77 of our Annual Report and Accounts 2023. We have increased the accuracy of our emissions data gathering and have adjusted the FY22 base year figures where appropriate if more reliable data is now available. For example, where reliable country level carbon conversion rates have now become available, we have adjusted the prior year reported emissions to ensure a like-for-like comparison year-on-year. Where there is uncertainty and assumptions are used, we have detailed the assumptions and disclosed sensitivities to the assumptions.

Our perimeter includes all companies and subsidiaries in the Group. Our base year for target setting aligned with SBTi is 2022 to ensure we are using as accurate a base position as possible. As we grow in part through acquisition, the base level will be re-assessed when appropriate and targets will be adjusted accordingly.

c. The targets used by the organisation to manage climate‑related risks and opportunities and performance against targets

In FY2022 we set new targets for carbon reduction over the short, medium and long term which will enable us to achieve our commitment to a net zero carbon future. This year we have disclosed the disaggregated annual targets and report the performance against those targets for the year FY23 in the tables on page 76 of our Annual Report and Accounts 2023. The targets were set in line with the principles of Science Based Initiatives, and we will continue to refine our targets before being approved by Science Based Initiatives later in the year.

We have continued to deliver a year-on-year reduction in our chosen measure of carbon intensity, reducing by 9.8% since last year, cumulatively 69.8% lower than nine years ago when we first started reporting this measure.

We have also delivered a year-on-year reduction in absolute scope 1 and scope 2 emissions despite the growth of the business both organically and through acquisition. Some of the actions taken by our colleagues to deliver this are shown on page 78 of the Annual Report and Accounts 2023.

The annual targets include assumptions on (i) Passive reductions – those that will happen without any action from Volution such as decarbonisation of the electricity grid, (ii) Market-based reductions – those achieved by selecting “green” energy tariffs, (iii) Active reductions – those achieved by the deliberate actions of Volution making technological, behavioural and operational changes within the business, and (iv) carbon offsetting. For further details on the target setting please refer to the FY22 Annual Report.

Definitions – Carbon neutral

To offset carbon emissions, we purchase credits for carbon removal or avoidance projects (see page 83 of our Annual Report and Accounts 2023). Our 2023 carbon neutral status boundary includes all scope 1 and 2 emissions, colleague commuting and waste.

Definitions – Net zero

The maximum feasible emissions reductions of carbon have been made and only residual emissions are counterbalanced by carbon removal credits. Our net zero target boundary includes all scope 1, 2 and 3 emissions, both upstream and downstream.

Definitions – Science Based Initiatives

The Science Based Targets initiative (SBTi) is a global body enabling businesses to set ambitious emissions reductions targets in line with the latest climate science. It is focused on accelerating companies and financial institutions across the world to halve emissions before 2030 and achieve net zero emissions before 2050. Our letter of commitment confirms that we will set a long term science-based target to reach net zero value chain GHGs emissions by no later than 2050 in line with the SBTi Net-Zero Standard, submit it for SBTi validation and publish it, within the next 12 months.

Scope 3 Target – Carbon intensity (tCO2e / £m of revenue) and absolute emissions 2022 to 2050

This year, we have expanded the perimeter of our Scope 3 reporting to include all material categories. However, we have not yet included all of these additional categories in our Scope 3 target, so in order to maintain consistency this year, we will continue to report against the Scope 3 targets established last year, which took into account only the Scope 3 categories reported last year.